By Nigel Hughes

CoStar Analytics

April 2, 2024 | 10:42 AM

Amid a nationwide slowdown in investment sales, the multifamily market in San Jose, California, has been a standout performer in recent quarters.

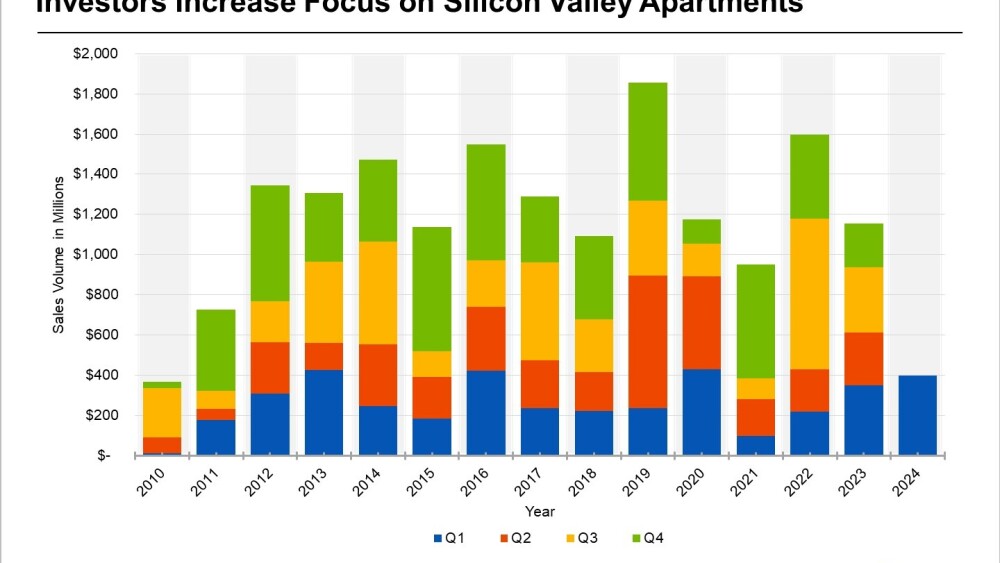

Silicon Valley saw a total sales volume of just under $1.2 billion in 2023, lining right up with the 10-year average. That trend has continued in the first quarter of 2024, with sales in the first three months of the year hitting $400 million, the highest first-quarter total since 2020.

Compare this with the national picture: Multifamily investment sales across the nearly 400 U.S. markets tracked by CoStar dropped by 61% in 2023. While San Jose’s sales volume in 2023 also fell from 2022, the decline was a much smaller 28%.

The factors that have attracted investors to San Jose include steady demand, low vacancy, stable rents and a modest supply pipeline. Unlike many Sun Belt markets, San Jose has seen limited new development in recent years. That’s helped vacancy to stay low, at close to 5% for the past year, and stabilized occupancy is over 95%. Across the United States, vacancy has increased to almost 8% and is much higher in many Sun Belt markets.

Rent growth in Silicon Valley, while modest, remained positive in 2023, and the market is forecast to see average rents increase by around 4% in 2024.

Average pricing for multifamily sales has also remained robust in San Jose. Most of the sales in the past year were for one- and two-star buildings, which achieved an average sale price of around $350,000 per unit, with an average cap rate of 4.9%. This is 80 basis points higher than the average cap rate for properties in this segment that sold between 2020 and the first interest rate hikes in 2022. Most other major markets have seen a larger increase in cap rates over the same period.

Higher-end buildings have also found buyers. For example, Hines acquired the Diridon West Apartments in downtown San Jose in January. The Houston-based investor purchased the 249-unit building for $117.5 million, or $472,000 per unit, and it was 95% leased at sale.

Next year, the number of new apartment properties completed in Silicon Valley will likely be high. However, strong demand should support solid leasing activity, giving investors confidence to continue seeking investment opportunities in the market.